CCAP ‘s VITA Tax Preparation Assistance Service

Do you need help with your taxes…CCAP can lend a helping hand with your tax preparation!

CCAP ‘s VITA Tax Preparation Assistance is a free service for low-income workers. Our IRS-trained tax preparers will help you file your federal and state income taxes. Tax preparation services are offered at our Cranston location: 311 Doric Avenue, Cranston, RI (lower level) – call us today for an appointment – 401-467-9610

What to Bring to prepare your taxes…

- Proof of identification (photo ID)

- Social Security cards for you, your spouse and dependents

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

- Proof of foreign status, if applying for an ITIN

- Birth dates for you, your spouse and dependents on the tax return

- Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

- Interest and dividend statements from banks (Forms 1099)

- All Forms 1095, Health Insurance Statements

- Health Insurance Exemption Certificate, if received

- A copy of last year’s federal and state returns, if available

- Proof of bank account routing and account numbers for direct deposit such as a blank check

- To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

- Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

- Forms 1095-A, B or C, Affordable Health Care Statements

- Copies of income transcripts from IRS and state, if applicable

Call us today for an appointment – 401-467-9610 – CCAP ‘s VITA Tax Preparation Assistance.

Related Posts

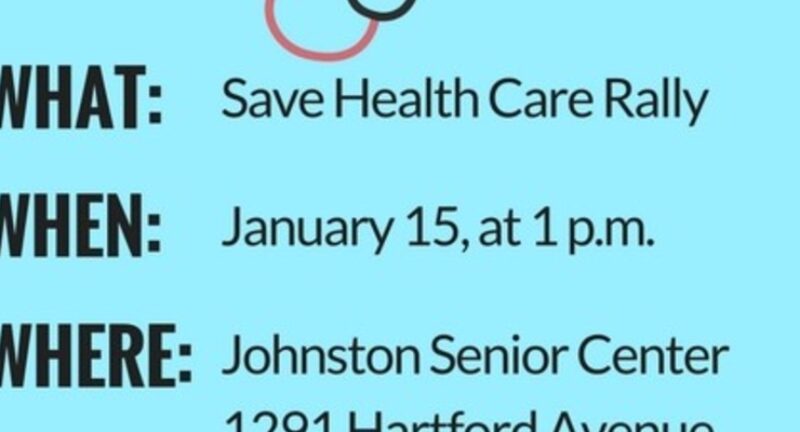

RIers to Rally to Help Save Our Health Care

January 10, 2017

RIers to Rally to Help Save Our Health Care JOHNSTON, RI – This weekend,...

Attention Cranston Residents…You and your child may be eligible for A FREE Early Education program!

July 14, 2017

Bright futures for children begin with great child care both at home and away....